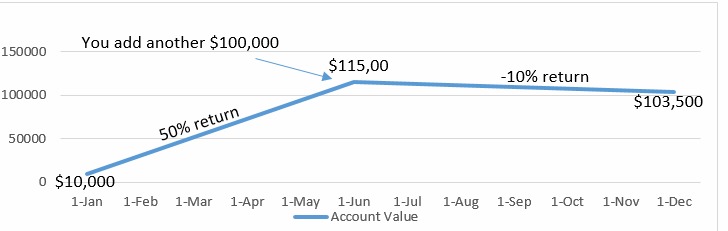

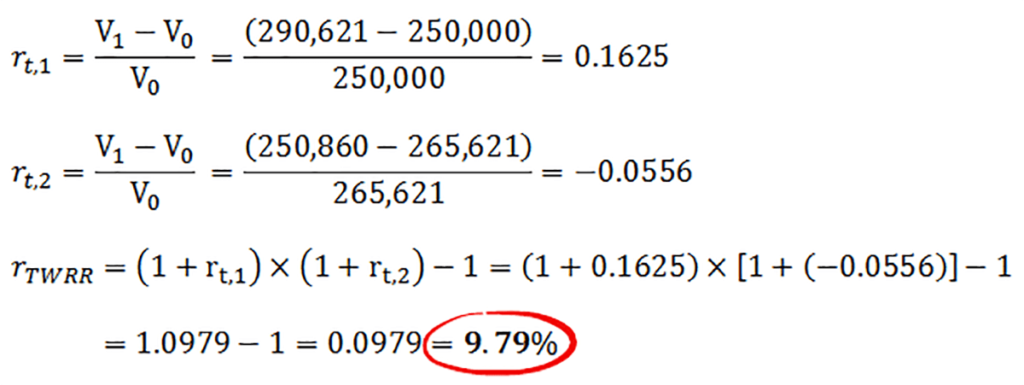

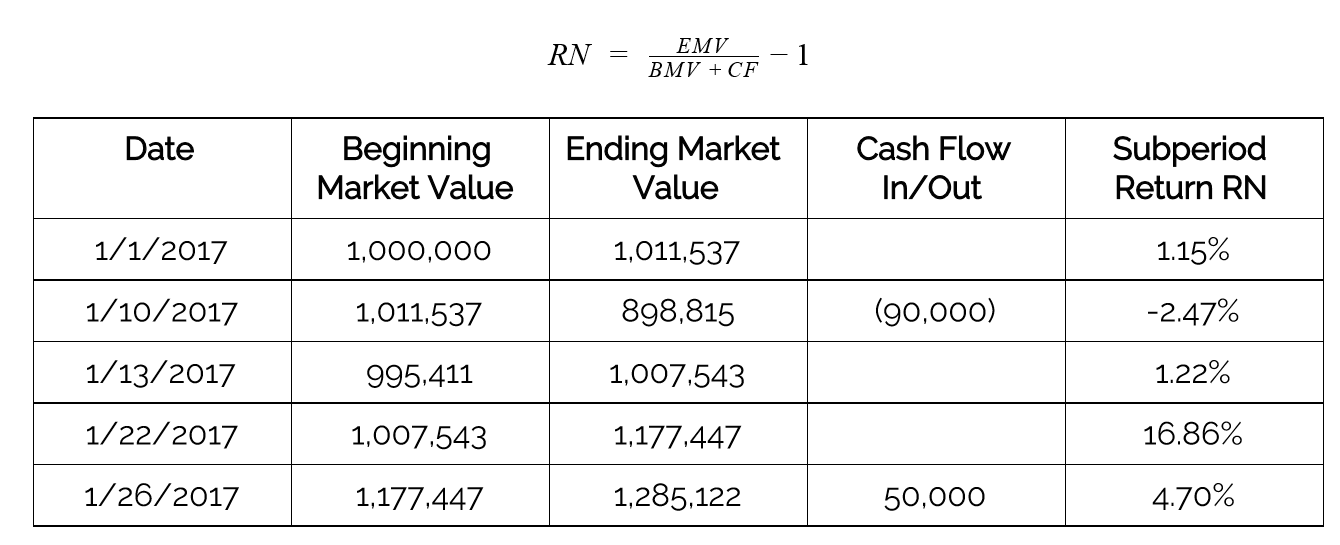

Jae Jun Blog | How To Calculate Your Time Weighted Return Portfolio Performance | Talkmarkets - Page 2

![PDF] Using Brinson Attribution to Explain the Differences between Time- Weighted (TWR) and Money-Weighted (IRR) Returns | Semantic Scholar PDF] Using Brinson Attribution to Explain the Differences between Time- Weighted (TWR) and Money-Weighted (IRR) Returns | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/26262457b956a0a6482f7f0faf3e66d82ade4d60/5-Table2-1.png)

PDF] Using Brinson Attribution to Explain the Differences between Time- Weighted (TWR) and Money-Weighted (IRR) Returns | Semantic Scholar

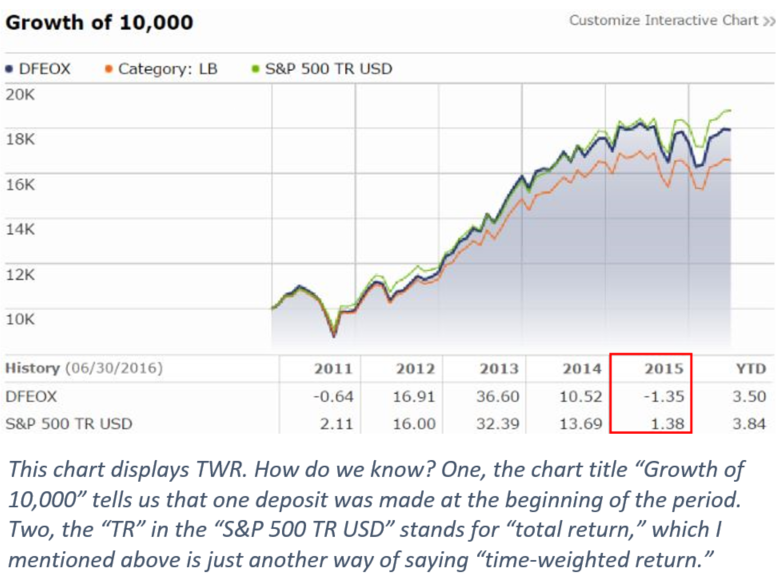

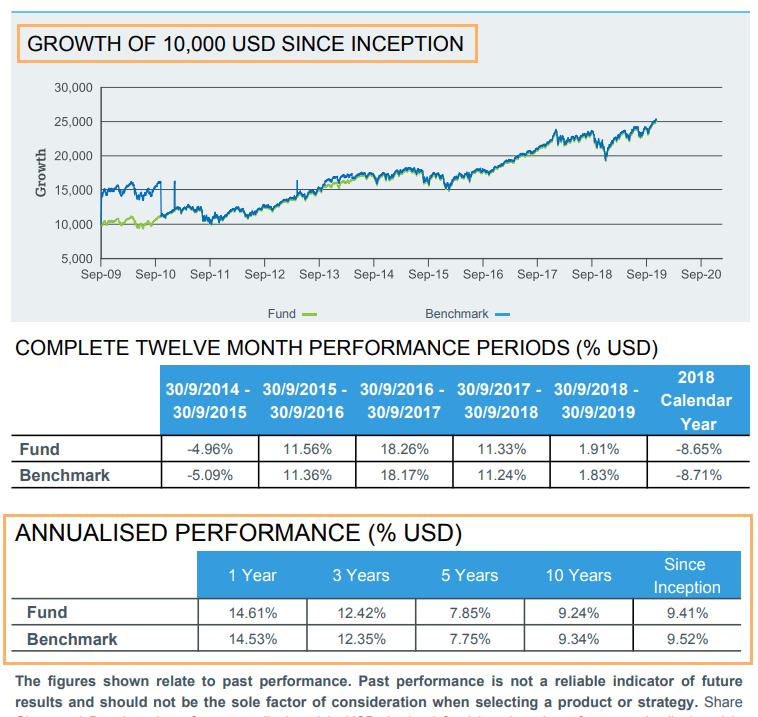

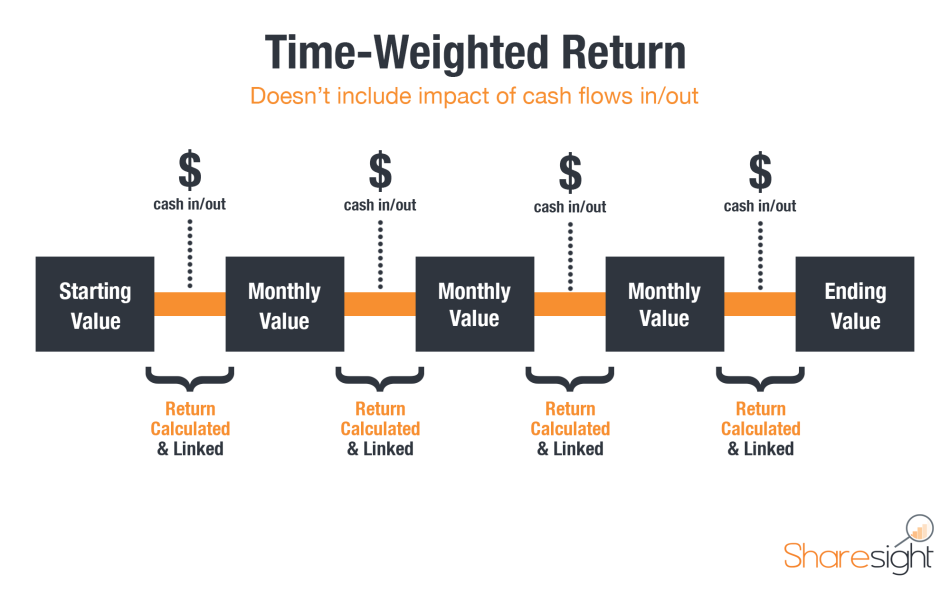

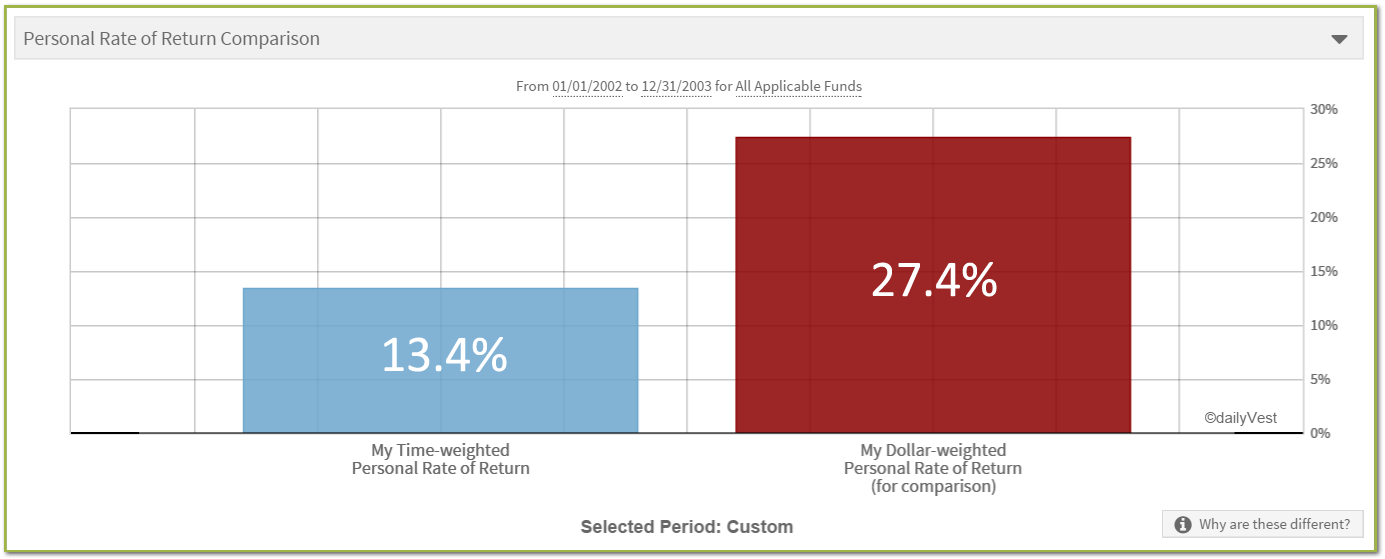

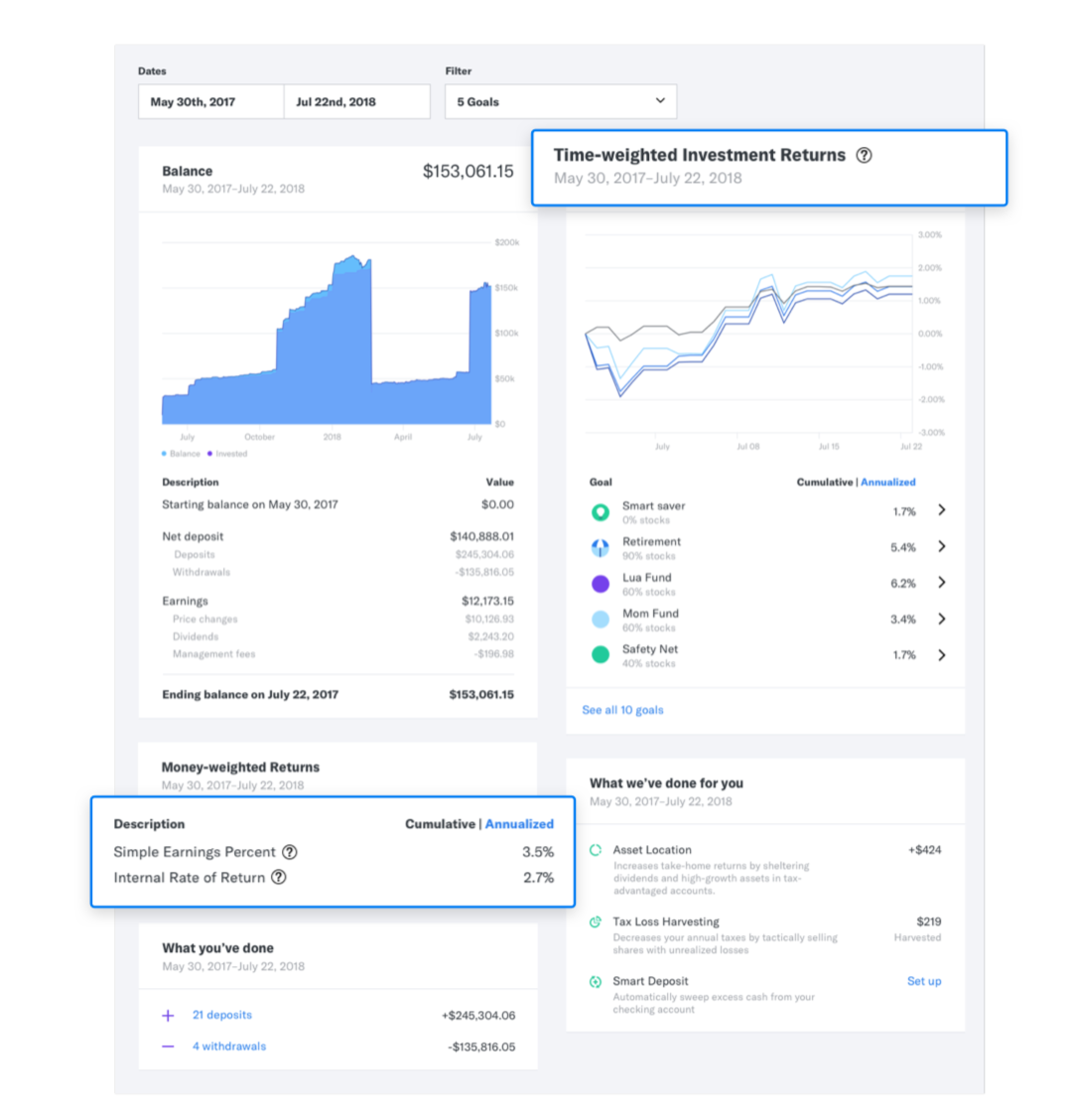

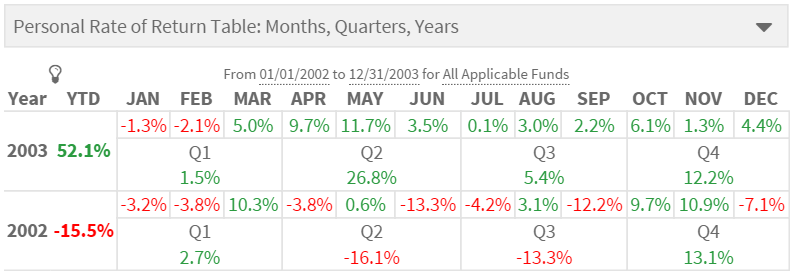

Time-Weighted Return – Only Tells Part of the Story - Time-Weighted Return – Only Tells Part of the Story | Actuaries Digital